I plan to provide a longer article every 4 to 6 weeks exploring a relevant topic in more detail.

This week ground-breaking research analyzing the financial performance of the 100 largest banks in the world was released showing banks that outperform on material sustainability issues also outperformed financially. This research was one of the last projects I worked on at the Global Alliance for Banking on Values. The research was conducted by KKS Advisors with support from the European Investment Bank and Deloitte in addition to the Global Alliance. The summary chart from the report was featured in the Financial Times Moral Money article of 11 December 2019. The full report can be downloaded from the Global Alliance from this link.

This research builds on the long time research of the Global Alliance that compared the financial profiles of the largest banks in the world – the banks too big too fail – with the members of the Global Alliance. This research grew out of the initial actions following the 2010 meeting of the Global Alliance in Dhaka, Bangladesh hosted by BRAC Bank. At that meeting we decided to look at two issues: 1) developing sources of capital for values-based banks and 2) developing metrics to measure not only financial but also social and environmental results in banking.

To make the business case for investing capital in values-based banks, the Global Alliance decided to look at the financial profiles of values-based banks with the Global Systemically Important Banks as defined by the Financial Stability Board (e.g. the banks too big to fail). This research was published in early 2012 with data through yearend 2010. It has subsequently been updated on an annual basis.

The results of the comparisons showed substantial differences between the two sets of banks. Values-based banks had a very significantly greater exposure to the real economy, a great reliance on client deposits for funding, stronger capital positions, and stronger and more stable financial returns when compared with the largest banks in the world. In other words those banks that claim to be shareholder driven were actually delivering poorer results than banks focused on delivering social and environmental results for the communities in which they operate.

However, the research of the Global Alliance was criticized for comparing apples and oranges (e.g. small niche banks and large global banks) and not analyzing the financial returns from an investor perspective. The challenge was to address these two issues with another research approach. In research published in 2016, it was shown that firms with good ratings on material sustainability issues significantly outperform firms with poor ratings. This research developed by George Serafeim of Harvard Business School among others did not focus on banks.

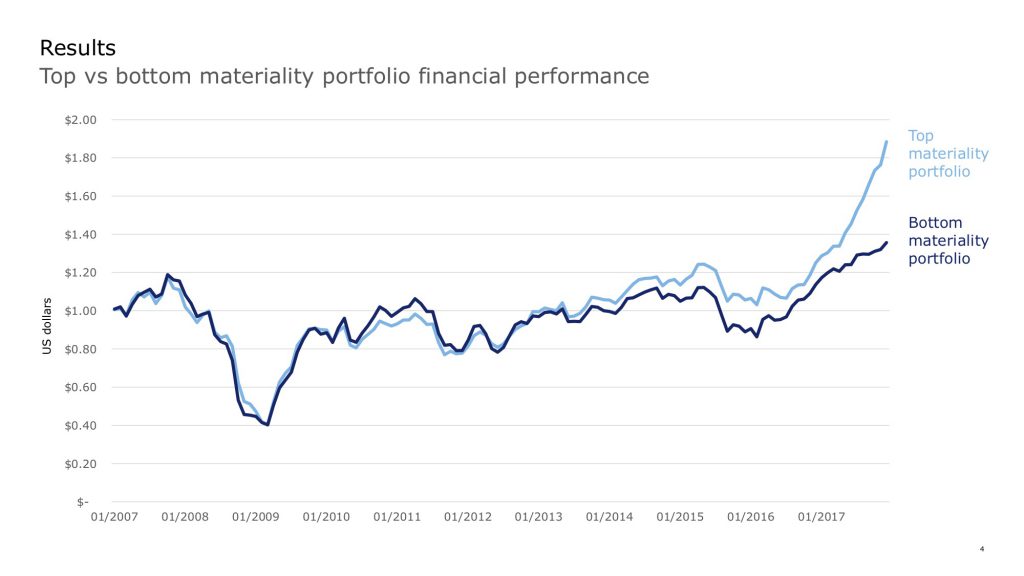

The recently released research used publicly available data for the 100 largest international banks by market capitalisation as of September 2018 to determine if a focus on material sustainability issues as defined by the Sustainability Accounting Standards Board led to better financial performance relative to returns to investors. The results showing that this was the case are summarized in this chart.

I would encourage you to read both the GABV research as well as the new report. I believe both show that a focus on values-based banking is compelling not only due to its ability to deliver social and environmental results but also financial results for investors. Values-based banks by focusing on delivering value to society, deliver value to their investors.

There are many more research issues raised by the new report. And the exploration of the drivers of success are not fully clear. I hope to further explore those issues in the future.