Lessons from history – learning from a prior period of climate change

As we face the potential of meaningful climate change, it can be helpful to see what happened the last time there was a significant change in the climate. Fortunately a German historian, Philipp Blom, has done quite some work for us in his book, Nature’s Mutiny. This book provides insight into how substantial changes in the climate lead to significant social, political and economic shifts. These shifts created both winners and losers with my current country of residence, The Netherlands, generally profiting from the increase in trade as goods, especially grain, moved from areas of production to areas of need. Given that future climate change is likely to significantly impact food production, looking at history can provide useful frameworks for the future.

As we face the potential of meaningful climate change, it can be helpful to see what happened the last time there was a significant change in the climate. Fortunately a German historian, Philipp Blom, has done quite some work for us in his book, Nature’s Mutiny. This book provides insight into how substantial changes in the climate lead to significant social, political and economic shifts. These shifts created both winners and losers with my current country of residence, The Netherlands, generally profiting from the increase in trade as goods, especially grain, moved from areas of production to areas of need. Given that future climate change is likely to significantly impact food production, looking at history can provide useful frameworks for the future.

The key factor driving societal changes was a decrease in average temperatures of around 2℃ in the North. This “Little Ice Age” between 1500 and 1700 was a significant change in climate with especially important consequences for food. Although the book notes it remains unclear what was the specific cause of this climate shift, it provides useful insight into the impact of the shift on society. From my perspective the book occasionally overstates its premise with all societal changes occurring in this time period being related to the climate change. Although I believe there is strong correlation between many economic consequences and the climate shift, attributing all of the cultural changes including the emergence of the scientific method to this shift seems to me to be overstating the case.

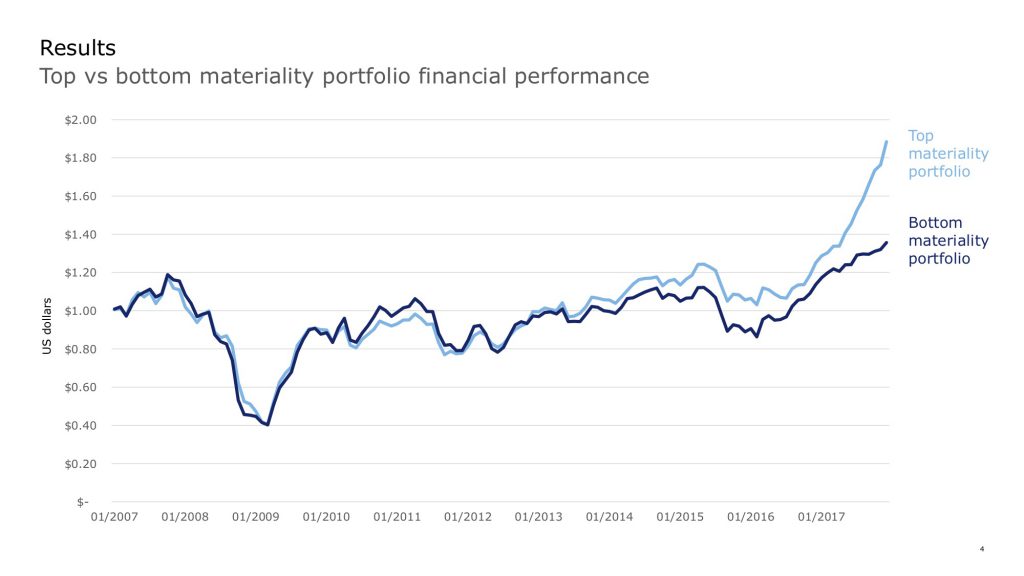

As we face the likelihood that the climate will be moving in a 2℃ plus direction, it is important for banks to consider the impact of likely economic changes on their portfolios. These impacts are likely to be not only economic for their clients but also social and political. Furthermore, I believe that values-based banking decisions should lead banks to use their risk allocation decisions to support efforts to mitigate potential climate impacts from resulting from a carbon driven economy.

In addition to his analysis of the impact of climate change, Blom provides a very cogent criticism of our current fixation in economics and politics on relying on markets to resolve all problems. He notes: “(t)his now-outdated neoliberal concept of how a human economy works does not begin with an understanding of human nature or social structures or goals. It elides complex motivations and constraints into a posited rational self-interest. Flying in the face of all evidence, it assumes that transactions in the marketplace happen on a free and equal footing, that both sides have the same amount of choice and information. No social reality throughout history supports that claim. It is inherently counterfactual, constructing what is in effect a theology of the market.” This historical driven criticism is a useful perspective from a naive economic model that relies on numerous assumptions that are not realistic in the world in which we exist.

As important as the overall book is in providing useful thinking about the impact to climate change on society and all of its aspects, I believe that this detailed criticism of a naive “belief” in markets is an even greater contribution of this book to the discussion on the role of markets and banks on society. A book well worth reading for new considerations on many fronts.