In an excellent and detailed article, Lex in the Financial Times highlights the substantial financial risk of stranded assets in carbon based fuels, estimated at over USD 900 billion. Although the focus of the article is more from an equity investment perspective, it provides a very useful context for banks to look at their exposures as well. Mark Carney, Governor of the Bank of England, has been noting this point for some time and has been encouraging banks to look at the risks on their balance sheets. His thoughts are usefully summarised in a Guardian article at the end of last year. Is your bank looking at this risk in its portfolio?

Let the sunshine in . . .

For bankers transparency is often a challenge. Confidentiality when used to protect the information of a client is worthwhile. However, banks too often use confidentiality to avoid public knowledge for challenges they face or errors they make. Recently HSBC settled an employment issue with the result that a potential whistleblower would not publicly provide information that might have been embarrassing. Credit Suisse similarly has not been public about their efforts to get information on Greenpeace regarding their focus on reducing Credit Suisse’s involvement in financing carbon related projects. In both cases the information slowly will come to the surface and likely lead to reputational damage. But then the real question should be why no one in the bank management challenged the dubious activities in the first place!!!

Overly concentrated banking – does diversity matter?

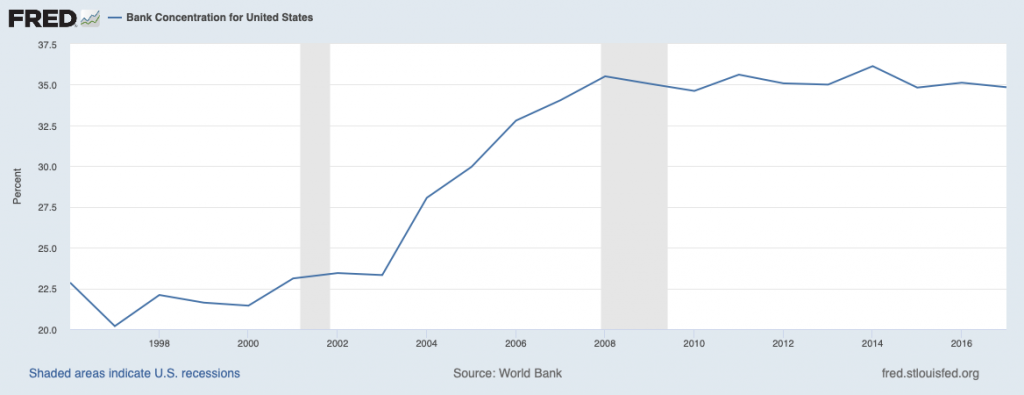

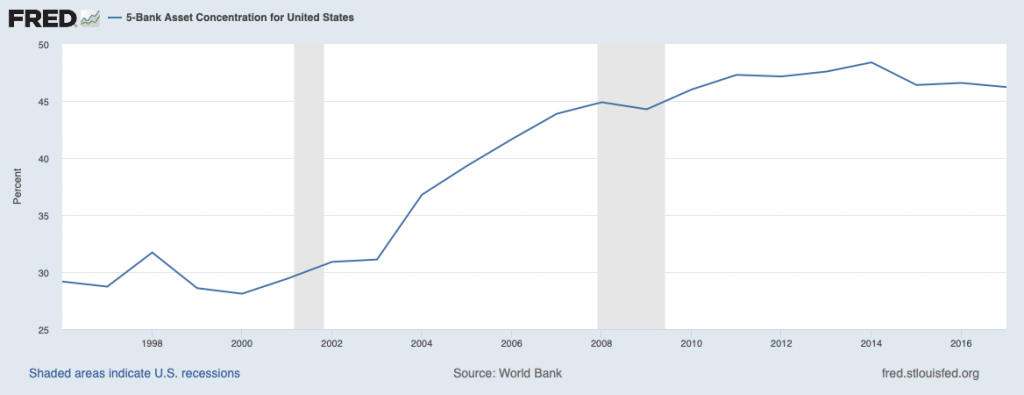

In Tuesday’s Financial Times, Robert Armstrong noted that the discussion on too big to fail in the US needed a new framework for discussion. He states that the impact of economies of scale in the US banking industry have led to higher concentrations. He is rather sanguine on the consequences of this development and notes that it is likely to continue. The concentration in the US can be seen in the following charts (alas data only available through yearend 2017):

A fundamental question to address is the impact of higher concentration. A standard concern is the increased vulnerability of the banking system as it becomes more concentrated – the too big to fail argument. However, it is possible that larger banks lose their capability to meet the needs of local clients – individuals and enterprises – as decision making becomes more centralised and removed from communities. Local community-based banks have historically provided finance for the new entrepreneur whose needs and situation benefit from local knowledge.

This concentration accelerated substantially after 2002. I believe it was driven by two factors: investment requirements for technology and additional regulatory complexity. Both factors create substantial fixed costs that are more easily absorbed by larger banks. Addressing these underlying causes of reduced diversity is essential to preserving a robust banking system that can meet the needs of local communities.

Looking for risk in all the right places

A recent publication from McKinsey provides a useful road map for bankers focused on risk from climate change. This publication not only provides a solid overview of the scientific facts supporting the view that climate change is real but goes further to highlight the many risks arising from climate change that can impact the risks of loans and investments made by banks. The questions remains which banks are focusing on identifying and mitigating these risks? And which regulators are incorporating these risks in their stress tests?#ban

Heads I win, tails you lose

A recent paper from Goodhart and Lastra focuses on the danger posed by limited liability for bank management. They “advocate moving towards a two-tier equity system, primarily for banks, with insiders, senior managers and others with influence over corporate decisions, becoming subject to multiple liability” to address these dangers. As noted by Jonathan Ford in the Financial Times, “by making insiders financially accountable for their actions, it would rebalance the calculus of fear versus greed.” Clearly the lack of accountability for the financial crisis for nearly all bank managers is an issue that needs to be addressed. But are the banks ready to make this change or do they prefer (as managers) to be immune from the consequences of their actions.